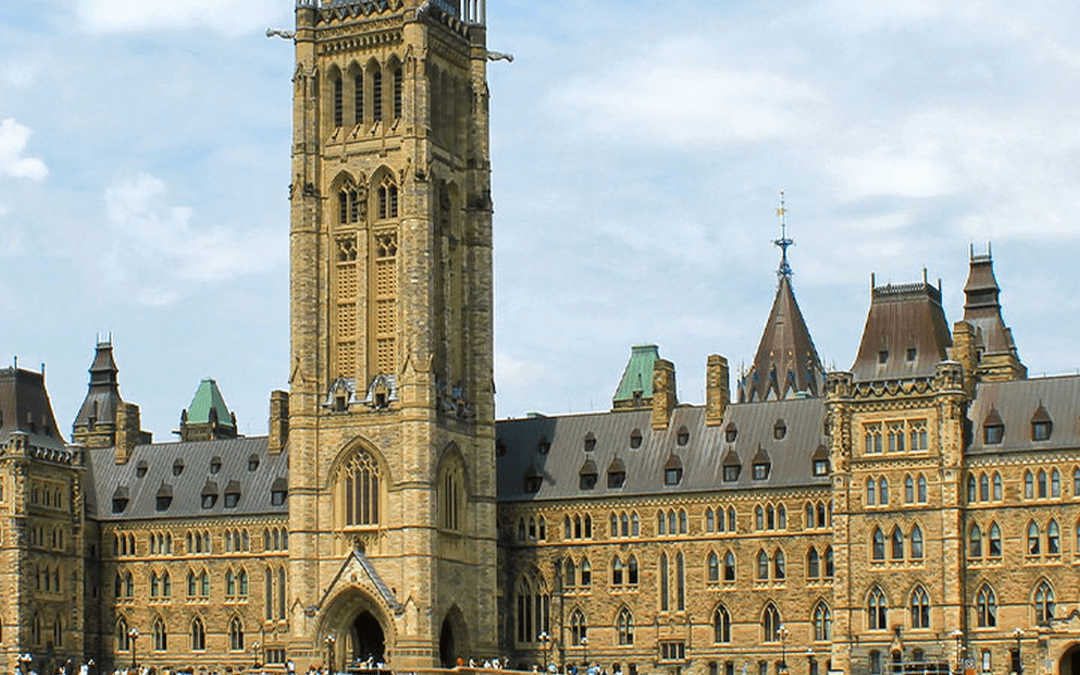

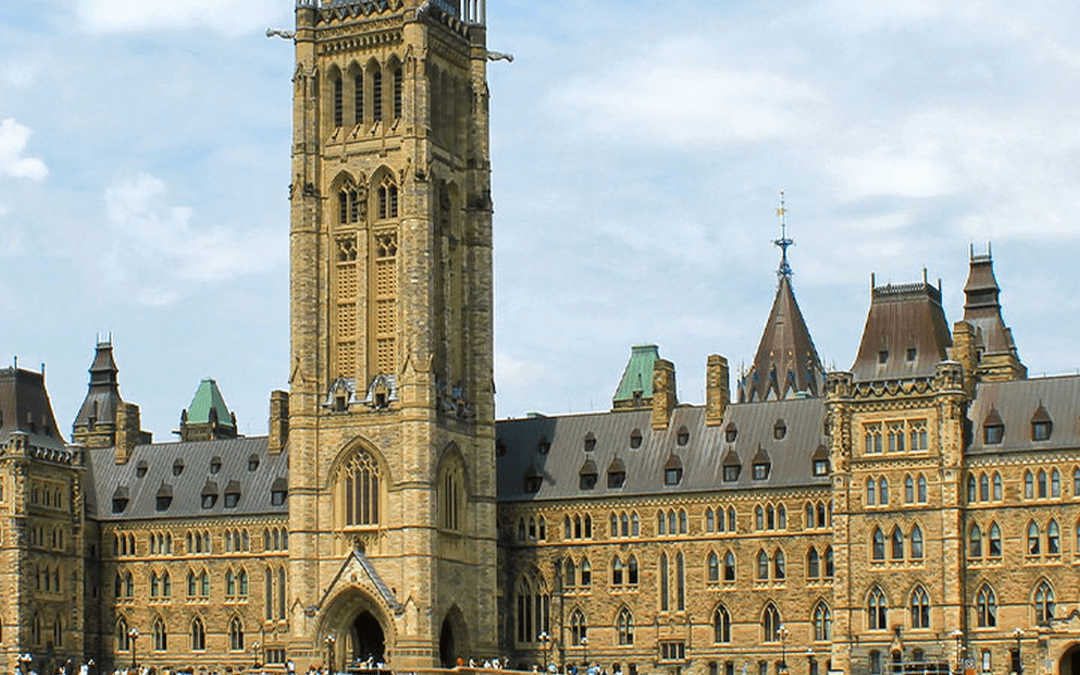

by Don Breckenridge | Apr 17, 2024 | General Resources, News, Tax Alert

RESOURCE 2024 Federal budget commentaryARTICLE | April 17, 2024Authored by RSM CanadaCanada’s 2024 Federal Budget (Budget 2024), delivered by Deputy Prime Minister and Finance Minister Chrystia Freeland on April 16, 2024, addresses critical economic challenges faced...

by Ashley Lafontaine | Mar 28, 2024 | General Resources, News, Tax Alert

RESOURCE Important Update – Bare Trusts Exempt from 2023 Trust Reporting Requirements As we approach the April 2, 2024, trust filing deadline, we wanted to ensure you are promptly informed about a significant announcement from the Canada Revenue Agency (CRA) regarding...

by Ashley Lafontaine | Mar 22, 2024 | General Resources, News, Tax Alert

RESOURCE 2024-2025 Saskatchewan Provincial Budget Highlights Saskatchewan’s 2024-25 Provincial Budget, recently tabled by Deputy Premier and Finance Minister Donna Harpauer, unveils investments in education, health care, and community development. With projected...

by Don Breckenridge | Feb 27, 2024 | Tax Alert

RESOURCE Canadian tax filing and payment deadlines for middle-market taxpayers for 2024ARTICLE | February 27, 2024Authored by RSM CanadaExecutive summaryTo simplify your tax-filing experience, we have compiled the key tax filing and payment deadlines for the...

by Don Breckenridge | Jan 8, 2024 | Tax Alert

RESOURCE Navigating the CEBA Loan Repayment and Understanding Canada’s Bare Trust RulesArticle | January 08, 2024Questions anwsered in this article include:1. What is the Canada Emergency Business Account (CEBA)?2. What is the deadline for CEBA loan repayment?3. What...

by StarkMarsh | Sep 6, 2023 | News, Tax Alert

RESOURCE Bare trust arrangements and the new trust reporting regime in CanadaARTICLE | September 06, 2023Authored by RSM CanadaBare trust arrangements and the new trust reporting regime in CanadaUnder new legislation for trust reporting in Canada, bare trust...

Recent Comments