WEALTH MANAGEMENT

RESOURCE

Retirement Income – Personal and Corporate

Overview

While in the workforce, income is typically earned from one or two sources. However, in retirement, income will likely come from a variety of sources that could include government benefits, public or private pension plans, withdrawals from personal savings, and dividends from business interests.

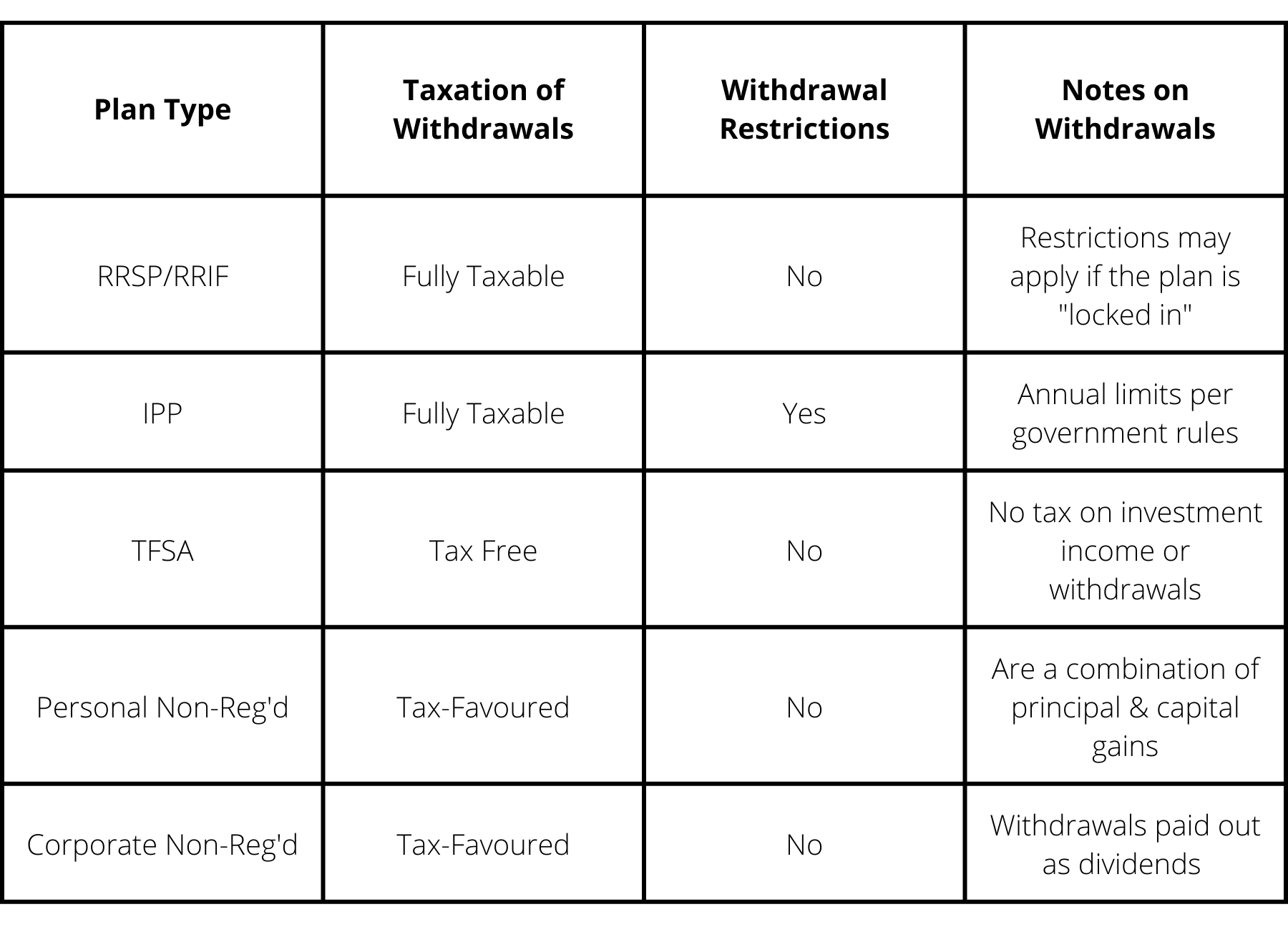

Savings may be in any combination of the following investment accounts: Registered Retirement Savings Plans (RRSPs), Registered Retirement Income Funds (RRIFs), Individual Pension Plans (IPPs), Tax Free Savings Accounts (TFSAs), personal non-registered accounts, and corporate non-registered accounts.

Withdrawals from your RRSP, RRIF, or IPP are treated as fully taxable income. These plans are basically tax-deferral plans – the contributions are tax-deductible and the investment earnings grow tax-free while in the plan, but all future withdrawals will be 100% taxable. Typically, if either spouse is age 65 or older, a couple can elect to split this income to reduce taxes. By contrast, withdrawals from TFSAs are completely tax-free.

Withdrawals from personal non-registered savings receive partial tax-favoured treatment the money received is often a combination of a return of after-tax capital, plus some realized capital gains. Therefore, the income tax is typically modest. Income tax will also be paid on the investment income earned by the portfolio over the year.

Withdrawals from corporate savings are typically taken in the form of dividends, resulting in tax-advantaged income due to the dividend tax credit available on Canadian dividend income. Annual investment income earned on corporate savings is taxed at the top marginal rate.

Quick Facts

- Income at retirement may come from many sources, including government and private benefits, and personal and corporate savings:

- RRSP, RRIF, or IPP withdrawals are fully taxable income. Private pension income and CPP benefits are also fully taxable. Individuals 65 or older can split any of this income with a spouse to reduce their combined taxes.

- Withdrawals from corporate savings are normally taken as dividends in retirement, which receive tax-favoured treatment, or could even be tax-free (if paid from the capital dividend account).

Planning Considerations

- Individuals who are 65 or older can split eligible pension income (RRSP/RRIF, RPP, annuity) with a spouse as a means to balance incomes and reduce income taxes. If there is income from a private pension plan, income can be split as early as age 55.

- In retirement, review and optimize investment withdrawals to leave minimal RRSP/RRIF holdings for an estate. This could help reduce estate taxes.

- Business owners may wish to draw dividends in retirement to draw down the value of their corporate holdings over a number of years to maintain a lower average tax rate.

- Pending changes to the income tax act will impact the strategies for dividends and corporate savings.

- Business owners should carefully manage the amount of dividends drawn at age 65 or older – under tax rules, the “taxable” amount of dividends is a “grossed-up” figure that could push income into OAS claw-back territory sooner than expected.

- Contributions to the TFSA can be made at any time throughout your lifetime, including retirement. These savings can grow into a significant tax-free asset that can provide funds for additional retirement needs, emergencies, or provide a tax-free asset for your estate or named beneficiaries.

- Your accountant, along with other financial advisors, should be consulted to establish a retirement income strategy that minimizes income taxes and OAS claw-back.

Questions about Stark & Marsh Wealth Management Services? Reach out to Candace Gelleta our Wealth Management Advisor directly by completing the contact form below.

Candace Gelleta CFP®, RRC®

SENIOR WEALTH MANAGEMENT ADVISOR

Candace has been actively involved in financial planning since 2014. She is a Registered Retirement Consultant RRC®, has a Financial Planning diploma from the Canadian Institute of Financial Planning, and has completed her Certified Financial Planner CFP® certification through FP Canada.

Candace works with Stark & Marsh clients to build a financial plan that considers Financial, Insurance, Retirement, and Estate needs. She works closely with the Stark & Marsh accounting and tax advisor to ensure the complete financial picture, including tax implications, are contemplated.

Wealth Services

Stark & Marsh offers a variety of comprehensive financial planning services to best serve your needs. Together with your Accountant, our Wealth Management team will work with you to ensure your short and long-term goals are at the forefront during the planning process.