WEALTH MANAGEMENT

RESOURCE

Managing Debt

Managing and reducing your debt is a great way to improve your overall financial situation.

Reducing your Debt

There are 4 major steps to help in your repayment plans:

1. Know Your Debt: Collect all relevant information surrounding your current outstanding debts. This should include all the following:

-

- Outstanding balance

- The interest rate

- Whether the loan interest is tax deductible

- Minimum monthly payment

- Payment due dates

- Current monthly payments

- Any penalties associated with repayment

2. Make the Minimum Payments: Ensure you are making the minimum payment on all your current outstanding debts. It is best to set these minimum payments up as automatic transfers, withdrawals, or payments to ensure that no payment is missed, as this will have a negative impact on your credit rating and could result in you defaulting on your loan.

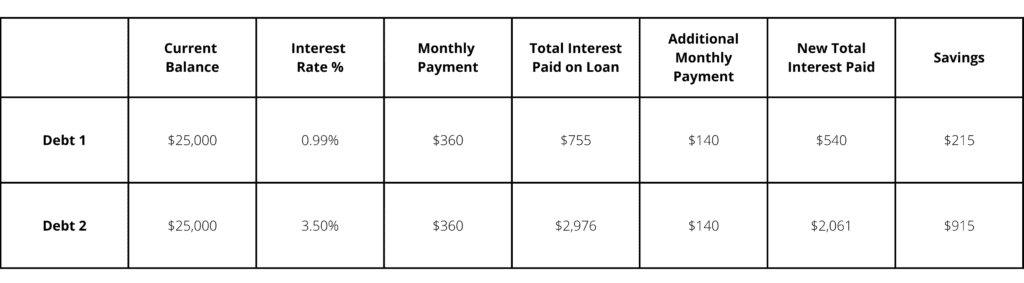

3. Additional Payments: Once you have ensured that you are making the minimum payments on your loans, the next step is to prioritize which debts to make additional payments against. Usually, it is best to start with the highest interest rate debt. This is because the resulting savings from the additional payment will be greater and can help to significantly shorten the loan (as seen below). To determine the most efficient repayment plan, meet with a Financial Planner.

4. Avoid New Debt: If debt repayment is your primary goal, it’s recommended that you avoid acquiring new unnecessary debts. This could mean extending the life of a vehicle or potentially delaying a home renovation.

Knowing Yourself

Although financially it always makes the most sense to start repaying your highest non-tax-deductible interest debt first, in practice it does not always provide the most long-term benefit. This is because if the balance is significant and will require repayment over a long duration, it can ruin your motivation making it difficult to stay disciplined and dedicated. From a psychological standpoint, starting with a low balance debt that can be paid off quickly can create the feeling of progress, which in turn can keep you motivated for longer. Therefore, it is recommended that you review your own behavior and habits to determine if you have the dedication to repay 1 single debt over multiple years, or if you need frequent reassurances that you are making progress. The balance between paying off high interest rates and low balance debts should be discussed in greater detail with a financial planner.

Emergency Fund

An often overlooked, but significant factor when it comes to managing debt is the establishing of an emergency fund. An emergency fund is a pool of cash reserves to be used to cover unexpected expenses. Emergency funds when used correctly can help you avoid acquiring more debt during already financially difficult periods of time, or reacquiring debt once everything is paid off. It is best to discuss with a financial planner the overall ideal size of your emergency fund. As well as reviewing where on the priority list funding an emergency fund should come when compared to repayment of your current loans.

Debt Consolidation & Consumer Proposals

If you are finding it difficult to make the minimum payments required on your current outstanding loans, there are options available to you, for example debt consolidations and consumer proposals. These options can offer significant benefit if you remain dedicated, however they can also lead to significantly more debt, if you do not gain control over your spending. Therefore, these options should be reviewed with an adviser to ensure they are the right fit for you.

Questions about Stark & Marsh Wealth Management Services? Reach out to Candace Gelleta our Wealth Management Advisor directly by completing the contact form below.

Candace Gelleta CFP®, RRC®

SENIOR WEALTH MANAGEMENT ADVISOR

Candace has been actively involved in financial planning since 2014. She is a Registered Retirement Consultant RRC®, has a Financial Planning diploma from the Canadian Institute of Financial Planning, and has completed her Certified Financial Planner CFP® certification through FP Canada.

Candace works with Stark & Marsh clients to build a financial plan that considers Financial, Insurance, Retirement, and Estate needs. She works closely with the Stark & Marsh accounting and tax advisor to ensure the complete financial picture, including tax implications, are contemplated.

Wealth Services

Stark & Marsh offers a variety of comprehensive financial planning services to best serve your needs. Together with your Accountant, our Wealth Management team will work with you to ensure your short and long-term goals are at the forefront during the planning process.